News

BlackRock's Bitcoin-ETF verzeichnet Zuflüsse in Höhe von $526 Millionen

iShares Bitcoin Trust (IBIT) von BlackRock Ein Spot-Bitcoin-ETF (Exchange Traded Fund, ein börsengehandelter Fonds), verzeichnete am 22. Juli einen erheblichen Zufluss von 526 Millionen Dollar. Dies stellte den größten Tageszufluss seit März dar. Durch diesen Zufluss stiegen die verwalteten Vermögen des IBIT auf über 22 Milliarden Dollar. Es war der siebtgrößte Tageszufluss für den IBIT, bei einem vorherigen Rekord von 849 Millionen Dollar am 18. März. Nettozuflüsse für Bitcoin-ETFs Insgesamt erreichten die Nettozuflüsse für alle US-Spot-Bitcoin-ETFs an diesem Tag 530 Millionen Dollar, das höchste Niveau seit über sieben Wochen. Neben BlackRock verzeichneten auch andere ETFs wie der Fidelity Wise Origin Bitcoin Trust und der Invesco Galaxy Bitcoin ETF beträchtliche Zuflüsse. Dabei machte der IBIT von BlackRock über 98% der Gesamtsumme aus. Anstieg der ETF-Nachfrage Analysten führen den Anstieg der ETF-Nachfrage auf eine verbesserte Stimmung gegenüber Bitcoin und politische Entwicklungen, einschließlich einer möglichen Rückkehr von Trump in das Präsidentschaftsrennen, zurück. Die hohen Zuflüsse betonen das anhaltende und zunehmende institutionelle Interesse an regulierten Bitcoin-Investmentprodukten und festigen den IBIT als größten Bitcoin-Fonds weltweit.

Learn moreBreez integriert Unterstützung für das Liquid Network in sein Lightning SDK.

Das Breez SDK unterstützt jetzt auch das Liquid Network Das Breez SDK, bekannt für die Vereinfachung der Lightning Network-Integration für Entwickler, unterstützt jetzt auch das Liquid Network. Bisher haben Unternehmen wie Relai, Cake Wallet und CrowdHealth von den Lightning Network-Funktionen des SDK profitiert. Die neue Liquid-Unterstützung stellt eine bedeutende Erweiterung des Breez SDK dar. Das Liquid Network und seine Funktionsweise Das Liquid Network ist eine föderierte Sidechain, die L-BTC verwendet, einen Bitcoin-gestützten Token. Innerhalb des Netzwerks können Benutzer ihre L-BTC frei verwalten und bewegen, während das zugrundeliegende BTC von einer Föderation auf der Hauptchain gehalten wird. Dies macht den Ein- und Austritt etwas kontrollierter, da es einer Genehmigung bedarf. Vorteile der Liquid-Integration für Entwickler und Nutzer Durch die Liquid-Integration des Breez SDK erhalten Entwickler und Nutzer mehr Flexibilität. Im Gegensatz zum Lightning Network, bei dem Payment Channels (Zahlungskanäle) benötigt werden, erfordert Liquid keine solchen Kanäle. Dies bedeutet, dass Einrichtungsgebühren, das Management von Liquidität und mögliche überraschende Kanal-Schließungen entfallen. Dadurch wird die Entwicklung vereinfacht, da nur grundlegendes Senden und Empfangen von Geldern erforderlich ist. Weitere Interaktionen und Erweiterungen Wallets, die das Breez SDK mit Liquid verwenden, können weiterhin über Submarine Swaps, die von Boltz unterstützt werden, mit dem Lightning Network interagieren. Submarine Swaps ermöglichen es, nahtlos Zahlungen zwischen den beiden Netzwerken über sogenannte Atomic Swaps abzuwickeln. Das SDK unterstützt LNURL-Pay, LNURL-Withdraw (Abhebungen) und LNURL-auth (Authentifizierung) und plant, in Zukunft auch Fiat-On- und Off-Ramps sowie Multi-Device- und Multi-App-Integrationen zu integrieren. Weitere Informationen für interessierte Entwickler Die technische Dokumentation zur Liquid-Unterstützung im Breez SDK ist für interessierte Entwickler verfügbar.

Learn moreAsiens erster inverser Bitcoin-ETF startet morgen in Hongkong

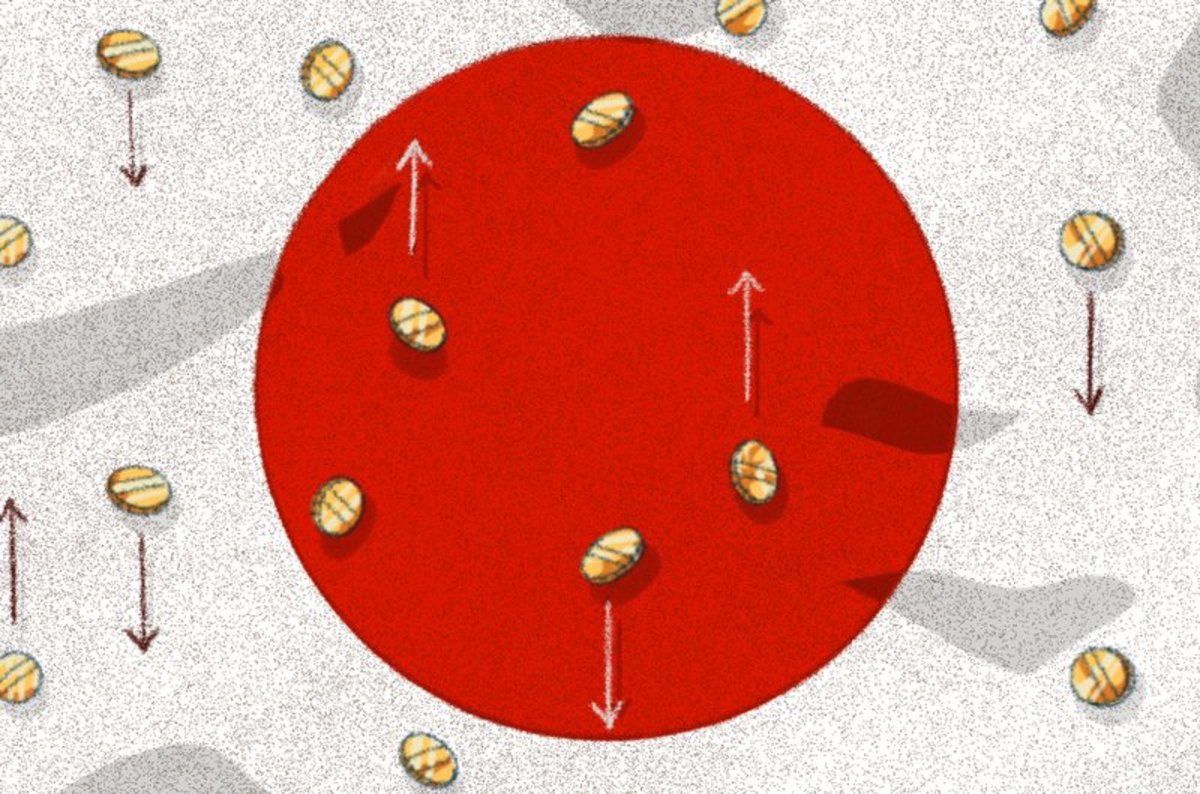

Die Einführung des inversen Bitcoin Exchange-Traded Fund (ETF) Die Hong Kong Stock Exchange (HKEX) wird am 23. Juli Geschichte schreiben, indem sie Asiens ersten inversen Bitcoin Exchange-Traded Fund (ETF) einführt. Funktionsweise des ETFs Ein ETF ist ein börsengehandelter Fonds, der wie eine Aktie an der Börse gehandelt wird. Das CSOP Bitcoin Futures Daily (-1x) Inverse Product wird durch das Eingehen von Short-Positionen auf Bitcoin-Futures-Kontrakte der Chicago Mercantile Exchange (CME) handeln. Eine Short-Position bedeutet, dass man auf fallende Kurse spekuliert. Trader können somit von der täglichen inversen Performance von Bitcoin profitieren, indem sie Gewinne erzielen, wenn der Bitcoin-Preis fällt. Dies bietet eine neue Methode, um Risiken abzusichern oder auf fallende Bitcoin-Preise zu spekulieren. Verwaltung und Ziel des ETFs Der ETF wird von der Firma CSOP Asset Management verwaltet und HSBC fungiert als Treuhänder. Treuhänder sind Institutionen oder Personen, die das Vermögen des ETFs verwalten. Der ETF erhebt eine jährliche Gebühr von 1,99% und hat das Ziel, innerhalb von ein bis zwei Jahren 50-100 Millionen Dollar an Anlagevermögen anzuziehen. Bedeutung der Einführung Diese Einführung markiert einen neuen Weg, die Volatilität von Bitcoin zu handeln, und ist das erste Produkt dieser Art in der Region, was die Stellung Hongkongs im 5,4-Billionen-Dollar-Aktienmarkt weiter stärkt. Diese Entwicklung stellt einen weiteren Schritt in Richtung der Mainstream-Adoption von Bitcoin in Asien dar, insbesondere nach dem Erfolg ähnlicher Produkte wie dem ProShares Short Bitcoin ETF (BITI) in den USA.

Learn moreTrump bezeichnet Bitcoin-Erfahrung als "Augenöffner": "Es verschwindet nicht"

Donald Trump - Ein neuer Befürworter von Bitcoin Donald Trump, der zuvor Bitcoin und Kryptowährungen skeptisch gegenüberstand, ist nun ein vehementer Befürworter geworden. In einem Interview mit Bloomberg Businessweek gab er zu, dass Bitcoin "nicht verschwinden wird" und forderte die USA auf, bei der Bitcoin- und Krypto-Innovation eine führende Rolle zu übernehmen. Dabei wies er auf die Fortschritte Chinas in diesem Bereich hin. Trumps Engagement mit Kryptowährungen Trumps Meinungsänderung folgt auf sein Engagement mit Kryptowährungen während seiner Kampagne 2024, einschließlich Bitcoin Lightning-Spenden. (Bitcoin Lightning ist eine Technologie, die schnellere und kostengünstigere Bitcoin-Transaktionen ermöglicht). Er betonte seine positiven Erfahrungen und die Notwendigkeit für die USA, eine bedeutende Position in diesem Bereich zu sichern. Trump zeigte sich besorgt darüber, dass China den Markt dominieren könnte. Er hob die Bedeutung des Bitcoin-Minings in den USA hervor und sprach sich gegen die Einführung eines digitalen Dollars aus, da dies die Bedeutung des US-Dollars schmälern würde. Trumps Pläne für Bitcoin und Kryptowährungen Mit dem Bitcoin-Befürworter J.D. Vance als Vizekandidaten plant Trump, Bitcoin und Kryptowährungen zu zentralen Themen seiner Plattform zu machen. Er wird eine Grundsatzrede auf der Bitcoin 2024 Konferenz in Nashville halten. Trumps neue Unterstützung zeigt die wachsende Akzeptanz von Bitcoin im Mainstream. Sollte Trump in die Präsidentschaft zurückkehren, könnten bedeutende pro-Bitcoin-Politiken bevorstehen.

Learn moreBitso brings Bitcoin Lightning to its 8 million users with Lightspark

Bitso and Lightspark partnership for the Bitcoin Lightning Network Bitso, a leading Latin American crypto exchange, has partnered with Lightspark to integrate the Bitcoin Lightning Network into its platform. This move aims to enable faster and cheaper Bitcoin transactions for Bitso's eight million retail users and 1,700 institutional clients. Lightspark will manage the nodes in the network, while Bitso will retain control of the private keys via remote signing. The importance of integration in Latin America The integration comes as the Lightning Network grows globally, increasing the speed and lowering costs of Bitcoin payments. According to Bitso's research, 53% of crypto wallets in Latin America contain Bitcoin, making the Lightning Network a natural extension of their infrastructure, especially for trading pairs against local fiat currencies (government currencies such as the US dollar or the euro). CEO statements and visions Bitso's CEO, Daniel Vogel, emphasized the importance of the partnership in advancing their mission to make crypto transactions faster, cheaper and more transparent. With the Lightning Network, Bitso can offer near-instant Bitcoin transactions at a lower cost, creating new opportunities for payment and remittance solutions. Lightspark CEO David Marcus highlighted the shared vision with Bitso to develop open payments for the internet, serving the demand for such solutions in Latin America. This partnership marks a significant step in driving Bitcoin adoption across Bitso's extensive user base.

Learn moreMt. Gox transfers $6 billion worth of Bitcoin

Bitcoin transfer to compensate Mt. Gox creditors The trustee for the rehabilitation of the insolvent Mt. Gox exchange transferred $6 billion worth of bitcoin on Tuesday to compensate creditors. On-chain data shows that Mt. Gox's wallet moved about 95,870 BTC (bitcoin) to new addresses in two transactions. The first transfer of 47,000 bitcoin was worth nearly $3 billion. The importance of Bitcoin transactions for Mt. Gox Although the target wallets are unidentified, they are believed to be part of Mt. Gox's repayment process. The exchange owes creditors $9 billion for lost bitcoin from the 2014 hack. These large transactions follow smaller test transfers made last week. Impact on Bitcoin price and creditors There are concerns that the payouts could affect the price of Bitcoin if creditors quickly liquidate their holdings (convert them into cash). In fact, the market has already reacted cautiously, leading to a drop below $64,000. However, most creditors are expected to hold onto their recovered coins rather than selling them immediately. A significant step in the Bitcoin industry These moves mark a significant step towards resolving one of the most notorious incidents in the Bitcoin industry. Over eight years after the collapse of Mt. Gox, affected early adopters will finally receive some of their losses back, underscoring Bitcoin's resilience and the community's commitment to responsible and transparent transactions.

Learn moreBitcoin price hits $63,000 after assassination attempt on Trump.

Bitcoin price rises after assassination attempt on Trump Bitcoin price surged above $63,000 following a failed assassination attempt on former US President Donald Trump at a campaign rally. The cryptocurrency climbed nearly 10%, from under $58,000 on Friday to over $63,000 on Monday morning. The sharp rise followed a shooting at a Trump rally in Pennsylvania on Saturday, in which Trump suffered only minor injuries. Analysts see improved prospects Analysts attribute the price increase to the improved prospects for Trump's election in November. Trump's positive attitude toward Bitcoin and his promise to reduce regulatory restrictions make him popular among Bitcoin supporters. Confirming his continued support, Trump's team announced that he will attend the Bitcoin 2024 conference in Nashville in two weeks. Bitcoin overcomes 200-day average Strong trading volume accompanied Bitcoin's rise above its 200-day moving average, a key technical level often seen as a bullish indicator (indication of rising prices) following recent market pressure. Bitcoin is recovering from previous lows near $53,000, caused by selling related to the Mt. Gox payouts (repayment of Bitcoin lost in the Mt. Gox exchange's bankruptcy) and actions by the German government. The market sees this bounce as a potential bottom, and further gains could push Bitcoin toward its previous all-time highs, especially with the possibility of a Trump presidency.

Learn moreGermany's Bitcoin sales ending soon: Less than $1 billion left.

German government continues liquidation of Bitcoin The German government has transferred another 2,375 bitcoins, worth approximately $138 million, to exchanges. This continues a months-long process of liquidating seized reserves originally acquired in 2013 following the seizure of nearly 50,000 bitcoins by the Federal Criminal Police Office (BKA) from the now-defunct piracy website Movie2K. Selling Bitcoin affects price Since mid-June, Germany has been steadily selling over 25,000 bitcoin, worth about $1.5 billion. The recent transfers leave the government with about 13,100 bitcoin, worth $765 million. The sales have contributed to a decline in bitcoin's price, which fell below $55,000 in July due to heavy selling pressure. Analysts suspect that as the government's bitcoin reserves dwindle, the selling pressure will ease, potentially leading to price stabilization. Predictions and criticism Experts predict that at the current rate, Germany's bitcoin holdings could be completely liquidated by September. The sales have sparked criticism from bitcoin supporters in the German Bundestag, who argue the government should keep the digital currency rather than convert it into euros. Positive price development for Bitcoin possible Despite the controversy, the liquidation has netted Germany over $1.5 billion. As the end of the government's Bitcoin reserves approaches, market conditions could change, potentially leading to positive price action for Bitcoin.

Learn moreMore Samourai devices seized: Bitcoin privacy activist appears in court before bail

First public court hearing for developers of the Samourai Wallet Today saw the first public court hearing for Samourai Wallet developers William Lonergan Hill and Keonne Rodriguez since May 28, 2024. Hill was extradited from Lisbon, Portugal, and the hearing was led by prosecutors. Important points of the negotiation Hill was indicted on July 9, 2024. 27 electronic devices were seized from Hill and their data is currently being reviewed by the FBI (Federal Bureau of Investigation). Evidence has already been handed over to Rodriguez and will be shared with Hill after review. Hill will be released on bail, although the amount of the bail was not disclosed. Hill bail conditions The bail conditions allow Hill to live in Lisbon under surveillance through an FBI-controlled ankle bracelet system. He must return to New York for necessary court appearances. The next hearing is scheduled for September 10, 2024, and prosecutors plan to release additional evidence by then.

Learn more