News

Bitcoin: 98,5 % der Zeit profitabel - Daten enthüllen die Erfolgsbilanz

Bitcoin als profitables Investment Das Halten von Bitcoin war in 98,5 % seiner Existenz profitabel, was 5.020 von insgesamt 5.096 Tagen entspricht. Seit August 2010, als Bitcoin bei $0,07 gehandelt wurde, ist sein Preis auf etwa $66.500 gestiegen, was einem Zuwachs von 94.999.900 % entspricht. Diese Daten unterstreichen das stetige Wachstum und die zunehmende Akzeptanz von Bitcoin. Diese Entwicklung wird durch die begrenzte Versorgung von 21 Millionen BTC (Bitcoin) und die steigende Nachfrage getrieben. Vorteile des langfristigen Haltens Der von Bitcoin Magazine Pro hervorgehobene Wachstumskurs betont die Vorteile des langfristigen Haltens, auch bekannt als "Hodling," trotz möglicher Marktrückgänge über 2-3 Jahre. Entgegen der Wahrnehmung hoher Risiken zeigen historische Daten signifikante Erträge beim langfristigen Halten von Bitcoin. Mit wachsender Akzeptanz wird erwartet, dass der Prozentsatz der profitablen Haltetage weiter steigt.

Learn moreDie größte Bitcoin-Konferenz der Welt kommt 2025 nach Las Vegas

Bitcoin Konferenz 2025 in Las Vegas BTC Inc. kündigt an, dass die Bitcoin Konferenz nach dem erfolgreichen Bitcoin 2024 Event in Nashville, das über 22.000 Besucher anzog, vom 27. bis 29. Mai 2025 nach Las Vegas verlegt wird. Dieser Umzug unterstreicht die Bedeutung von Bitcoin in einer schnell wachsenden, innovativen und Bitcoin-freundlichen Stadt. Gouverneur Joe Lombardo von Nevada betont die wachsende Bedeutung des Staates als Finanz- und Technologiezentrum und freut sich, das Event begrüßen zu dürfen. Vielfältiges Programm Die Teilnehmer können sich auf eine Vielzahl von Programmpunkten freuen, darunter verschiedene Podiumsdiskussionen (Panels), Möglichkeiten zum Netzwerken (Networking), Technologieausstellungen (Tech-Showcases) und Einblicke von führenden Branchenexperten. David Bailey, CEO von BTC Inc., kommentiert die Entwicklung von Las Vegas zu einem Zentrum für Unternehmertum und Innovation und bezeichnet die Stadt als idealen Veranstaltungsort für die Konferenz. Tickets und Nachfrage Die Tickets für das Event 2025 sind auf der offiziellen Website erhältlich, und es wird mit einer hohen Nachfrage gerechnet. Die Bitcoin Konferenz, das weltweit größte Treffen von Experten für Kryptowährungen, dient seit ihrer Gründung im Jahr 2019 als Plattform zur Förderung der Bitcoin-Einführung und zur Innovation innerhalb der Branche.

Learn moreRussland legalisiert Bitcoin und Krypto für den internationalen Handel zur Umgehung von Sanktionen.

Russland ermöglicht Nutzung von Kryptowährungen im internationalen Handel Russische Gesetzgeber haben ein Gesetz verabschiedet, das es Unternehmen ermöglicht, Bitcoin und andere Kryptowährungen für den internationalen Handel zu nutzen, um die westlichen Sanktionen nach der Invasion der Ukraine zu umgehen. Das neue Gesetz, das im September in Kraft tritt, soll internationale Zahlungsverspätungen, insbesondere mit China, Indien und den Vereinigten Arabischen Emiraten (VAE), adressieren. Zentralbankgouverneurin und Unterstützung des Gesetzes Die Zentralbankgouverneurin Elvira Nabiullina unterstützt das Gesetz. Sie erklärte, dass die ersten Krypto-Transaktionen bis Ende des Jahres beginnen werden, wobei eine "experimentelle" Infrastruktur eingerichtet wird. Die Gesetzgebung deckt auch Krypto-Mining (das Schürfen von Kryptowährungen mithilfe von Computern) und Regulierungen für digitale Assets (digitale Vermögenswerte, die auf Blockchain-Technologie basieren) ab. Sie behält jedoch ein Verbot von Krypto-Zahlungen innerhalb Russlands bei. Die Zentralbank verzeichnete einen Rückgang der Importe um 8 % im zweiten Quartal 2024 aufgrund von Zahlungsverspätungen durch die Sanktionen. Herausforderungen und Ziele des neuen Gesetzes Trotz Bemühungen, die Währungen der Handelspartner zu nutzen und ein BRICS-Zahlungssystem (ein alternatives Zahlungssystem der BRICS-Staaten: Brasilien, Russland, Indien, China und Südafrika) zu entwickeln, hängen viele Transaktionen weiterhin vom Dollar und Euro ab. Dies birgt das Risiko von sekundären Sanktionen (Zusatzsanktionen, die Dritte betreffen). Das neue Gesetz zielt darauf ab, wirtschaftliche Herausforderungen zu mildern und einen reibungsloseren internationalen Handel zu gewährleisten. Anatoly Aksakov von der Duma hob die Bedeutung dieser Gesetzgebung im Finanzbereich hervor.

Learn moreUS-Senatorin Cynthia Lummis kündigt Gesetzesentwurf zum Kauf von 1 Million Bitcoin an.

Senatorin Cynthia Lummis plant den Erwerb von 1 Million Bitcoin Senatorin Cynthia Lummis plant ein Gesetz, das die US-Regierung verpflichtet, 1 Million Bitcoin im Wert von über 68 Milliarden Dollar zu erwerben. Diese Ankündigung erfolgte auf der Bitcoin 2024 Konferenz in Nashville. Bitcoin als strategische Reserve Der Gesetzentwurf sieht vor, dass das US-Finanzministerium innerhalb von fünf Jahren Bitcoin kauft, um es als strategische Reserve zu nutzen, ähnlich der strategischen Erdölreserve. Lummis argumentiert, dass Bitcoin helfen könnte, die Staatsverschuldung, die kürzlich 35 Billionen Dollar überschritten hat, zu bewältigen. Die Bitcoin sollen von der Regierung selbst verwahrt und an verschiedenen Standorten für mindestens 20 Jahre gehalten werden und ausschließlich zur Schuldentilgung verwendet werden. Bitcoin zur Stabilisierung der Wirtschaft Als starke Befürworterin von Bitcoin im Kongress glaubt Lummis, dass der Erwerb von Bitcoin den Dollar stabilisieren und der Inflation entgegenwirken kann. Ihr Vorschlag folgt der Unterstützung von Ex-Präsident Donald Trump für eine US-Bitcoin-Reserve und stimmt mit dem Aufruf des unabhängigen Präsidentschaftskandidaten Robert F. Kennedy Jr. überein, täglich 500 Bitcoin zu kaufen, bis eine Reserve von 4 Millionen Bitcoin aufgebaut ist. Optimistische Perspektiven Obwohl Lummis zugibt, dass das Gesetz wahrscheinlich nicht vor den Wahlen 2024 verabschiedet wird, merkt sie das steigende politische Interesse an Bitcoin als Paradigmenwechsel an. Ihr Gesetzentwurf stellt einen bedeutenden Schritt in Richtung Regierungsübernahme von Bitcoin dar und könnte es als wirtschaftliches Asset legitimieren. Lummis bleibt optimistisch, dass andere auf Bitcoin fokussierte Gesetzentwürfe in diesem Jahr verabschiedet werden könnten, da Bitcoin politisch an Bedeutung gewinnt.

Learn moreRFK Jr. plant 4 Millionen Bitcoin zu kaufen, falls er zum US-Präsidenten gewählt wird.

Robert F. Kennedy Jr. und sein Bitcoin-Plan Der unabhängige US-Präsidentschaftskandidat Robert F. Kennedy Jr. kündigte auf der Bitcoin 2024 Konferenz an, dass er im Falle seiner Wahl vier Millionen Bitcoins für die US-Regierung kaufen würde. Kennedy plant, eine Executive Order (eine präsidiale Anordnung) zu unterzeichnen, die das US-Finanzministerium dazu verpflichtet, täglich 550 Bitcoins zu erwerben, bis dieses Ziel erreicht ist. Dies entspricht fast 20 Prozent des gesamten Bitcoin-Angebots. Außerdem beabsichtigt er, die derzeit von der Regierung gehaltenen 204.000 Bitcoins in eine strategische Reserve der Federal Reserve (die Zentralbank der USA) zu überführen. Kennedy behauptet, dies könnte den Wert von Bitcoin drastisch steigern. Bitcoin als Stabilisierungsfaktor Kennedy sieht Bitcoin als stabilisierende Kraft gegen die seiner Meinung nach schädlichen Auswirkungen einer schlechten Geldpolitik und hoher Inflation. Er ist überzeugt, dass die Einführung von Bitcoin die Anreize für militärische Konflikte reduzieren und die finanzielle Stabilität wiederherstellen könnte. Zudem schlug er vor, Bitcoin-Transaktionen steuerfrei zu machen und steuerfreie Tauschaktionen zu erlauben. Dabei hob er die Transparenz von Bitcoin im Kampf gegen Korruption hervor. Trotz eines Rückstands in den frühen Umfragen zielt Kennedys stark pro-Bitcoin ausgerichtete Haltung darauf ab, libertär gesinnte Wähler und die wachsende Bitcoin-Community anzusprechen.

Learn moreDonald Trump verspricht strategische Bitcoin-Reserve auf Bitcoin-Konferenz in Nashville.

Trump kündigt pro-Bitcoin-Versprechen an Auf der Bitcoin 2024 Konferenz in Nashville verkündete der ehemalige Präsident Donald Trump mehrere pro-Bitcoin-Versprechen für eine mögliche Präsidentschaft im Jahr 2024. Er möchte eine strategische nationale Bitcoin-Reserve etablieren und den "Anti-Krypto-Kreuzzug" von Joe Biden und Kamala Harris beenden. Trump will die USA zum Krypto-Führer machen Trump strebt danach, die USA zu einem globalen Führer im Bereich Kryptowährungen zu machen. Dies beinhaltet die Absicht, den Vorsitzenden der US-amerikanischen Börsenaufsicht SEC, Gary Gensler, zu entlassen und durch einen pro-Bitcoin-Nachfolger zu ersetzen. Des Weiteren plant er, die Bitcoin-Bestände der Regierung zu erhalten und schrittweise zu erhöhen. Bitcoin als Symbol für Freiheit Trump betont die wichtige Rolle von Bitcoin bei der Förderung von Freiheit und Unabhängigkeit von staatlicher Kontrolle. Er prognostiziert einen Anstieg des Bitcoin-Wertes im Falle seiner Wahl. Diese Aussagen wurden vom Publikum positiv aufgenommen und erhielten Unterstützung von Teilnehmern wie Andrew Campbell. Trump will Silk Road-Gründer begnadigen Des Weiteren verspricht Trump, den Gründer von Silk Road, Ross Ulbricht, zu begnadigen. Silk Road war ein Online-Marktplatz, der später wegen illegaler Aktivitäten geschlossen wurde. Diese Ankündigung führte zu einem 3%igen Anstieg des Bitcoin-Wertes. Robert F. Kennedy Jr. schlägt Bitcoin-Reserve vor Auch der unabhängige Kandidat Robert F. Kennedy Jr. nahm an der Konferenz teil und schlug eine Reserve von 4 Millionen Bitcoin im Falle seiner Wahl vor. Trumps Engagement für Bitcoin zielt darauf ab, Unterstützung aus der wachsenden Krypto-Community innerhalb der Republikanischen Partei zu gewinnen. Die positive Resonanz in Nashville deutet darauf hin, dass diese Strategie wirksam ist, um Bitcoin-bezogene Unterstützung zu gewinnen.

Learn moreUniversität von Wyoming gründet erstes Bitcoin-Forschungsinstitut

UW Bitcoin Research Institute an der University of Wyoming Die University of Wyoming hat das UW Bitcoin Research Institute gegründet. Dieses akademische Zentrum widmet sich ausschließlich der Erforschung von Bitcoin. Dr. Bradley Rettler, ein außerordentlicher Professor für Philosophie und Autor, wird die Leitung übernehmen. Das Institut wurde auf der Bitcoin 2024 Konferenz angekündigt. Es hat das Ziel, die Qualität der Bitcoin-Forschung zu verbessern, akademische Positionen mit einem Schwerpunkt auf Bitcoin zu schaffen und junge Wissenschaftler zu fördern. Zudem will das Institut peer-reviewte Forschungsergebnisse, also wissenschaftlich geprüfte Arbeiten, für Journalisten, Politiker und die Öffentlichkeit bereitstellen, um bestehende Forschungslücken im Bereich Bitcoin zu schließen. Strategische Vorteile der University of Wyoming Die strategisch vorteilhafte Lage der University of Wyoming, ihre interdisziplinäre Zusammenarbeit, der Zugang zu erneuerbaren Energien und ein unterstützendes regulatorisches Umfeld machen sie besonders geeignet für diese Initiative. Das Institut wird eng mit verschiedenen Abteilungen und Zentren innerhalb der Universität kooperieren. Spenden zur Unterstützung des Instituts sind steuerlich absetzbar, und Bitcoin-Spenden werden vollständig behalten.

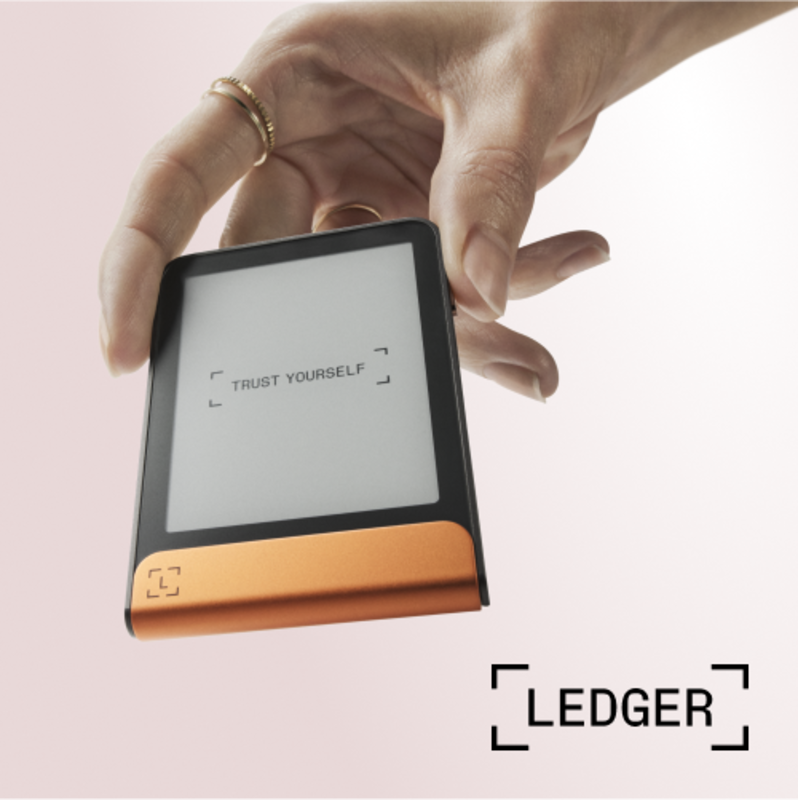

Learn moreNeu bei LEDGER FLEX: Live vorgestellt auf B24

Ledger Flex - Die neue Hardwarelösung von Ledger Ledger hat Ledger Flex vorgestellt, das zweite Produkt des Jahres 2024, das mit dem zehnjährigen Jubiläum des Unternehmens zusammenfällt. Ledger Flex kostet 249 USD und verfügt über einen sicheren E Ink®-Touchscreen (elektronisches Papier-Display), NFC (Near Field Communication, eine drahtlose Kommunikationstechnologie) und integriert Ledger's Secure OS (sicheres Betriebssystem). Es bietet zudem ein hochauflösendes 2,8-Zoll-Display und eine ausgezeichnete Akkulaufzeit. Verbesserte Sicherheit und Benutzerfreundlichkeit Diese Einführung folgt der früheren Vorstellung von Ledger Stax und markiert eine neue Generation von Ledger-Hardware, die die Sicherheit und Benutzerfreundlichkeit für das Management digitaler Vermögenswerte verbessert. Ledger Flex legt besonderen Wert auf robuste Sicherheit und stellt sicher, dass Nutzer Transaktionen und Logins sicher genehmigen können. Betonung der digitalen Vermögenswerte-Sicherheit Pascal Gauthier, CEO von Ledger, betonte die Bedeutung verbesserter Sicherheit digitaler Vermögenswerte, insbesondere angesichts der zunehmenden Digitalisierung von Werten und Identität. Ledger-Geräte, einschließlich der neuen Flex und Stax, sind darauf ausgelegt, diesen Sicherheitsanforderungen mit ihren einzigartigen sicheren Touchscreens gerecht zu werden. Erweiterte Sicherheits-App - Ledger Security Key Der Rollout von Ledger Flex umfasst auch eine begleitende App, den Ledger Security Key. Diese bietet Zwei-Faktor-Authentifizierung (2FA) und Passkey-Funktionen, die eine sicherere Alternative zu traditionellen Passwörtern darstellen. Die App basiert auf der offenen FIDO2-Spezifikation (ein Standard für starke Authentifizierung) und ist mit mehreren wichtigen Plattformen kompatibel, was die Sicherheit und Benutzerfreundlichkeit erhöht. Ledgers unübertroffene Sicherheit im digitalen Besitz Ian Rogers, Chief Experience Officer von Ledger, hob die unübertroffene Sicherheit hervor, die durch Ledgers sichere Touchscreens inmitten des Aufstiegs von digitalem Besitz und AI-generierten Inhalten (durch künstliche Intelligenz erzeugte Inhalte) geboten wird. Das Ledger-Ökosystem, einschließlich Ledger Live und Ledger Recover, unterstützt eine umfassende und sichere digitale Besitzerfahrung. Verfügbarkeit und Ergänzung der Produktpalette Ledger Flex ist auf der Website von Ledger und bei Best Buy in den USA erhältlich. Es ergänzt Ledgers Produktpalette, zu der auch das Nano S Plus, Nano X und Stax gehören, die jeweils unterschiedliche Funktionen und Preiskategorien bieten, um den verschiedenen Bedürfnissen der Nutzer gerecht zu werden.

Learn moreSichere deine Bitcoin-Schatzkammer mit einem YubiKey: Casa

Casa integriert YubiKeys in Bitcoin-Selbstverwahrungsdienste Casa hat YubiKeys, physische Authentifizierungsgeräte, in seine Bitcoin-Selbstverwahrungsdienste integriert. Dadurch können Nutzer ihre Bitcoin-Tresore nun zusätzlich sichern. YubiKeys bieten Multi-Faktor-Authentifizierung (MFA, eine Sicherheitsmaßnahme, die mehrere Verifikationsmethoden erfordert) und speichern sensible Daten sicher. Casa-Mitglieder haben nun die Möglichkeit, YubiKeys als einen der Schlüssel in ihren Multi-Signature Bitcoin-Tresoren zu verwenden. Seedphrase-Sicherheit durch YubiKey Bei der Ersteinrichtung mit Casa erstellen Nutzer eine Bitcoin-Seedphrase (eine Abfolge von Wörtern, die als Backup für Bitcoins dient) auf ihrem Computer. Diese Seedphrase wird dann auf dem YubiKey gespeichert und durch einen Passkey (ein zusätzlicher Sicherheitsschlüssel) geschützt. Diese Integration stellt sicher, dass die Seedphrase auf dem YubiKey verbleibt und nur über Casase Dienste zugänglich ist. Dadurch wird die Sicherheit im Vergleich zu traditionellen Recovery Seeds (Wiederherstellungs-Keys) erhöht, die anfällig für Phishing (Betrugsversuche zur Datendiebstahl) und Diebstahl sind. Die Seedphrase wird kryptografisch (durch Verschlüsselung) an Casase Domain gebunden, was Phishing-Risiken weiter reduziert. Flexibilität und Komfort durch YubiKey-Integration Diese Integration soll durch die kompakte Größe und die einfache Tap-to-Use-Authentifizierung (Berühren zur Nutzung) von YubiKeys mehr Flexibilität und Komfort bieten. Casa plant, den Integrationscode Open-Source (öffentlich zugänglich) zu machen, um die verstärkten Bemühungen zur Verbesserung der Bitcoin-Selbstverwahrung zu betonen, da die Nachfrage von privaten und institutionellen Nutzern steigt.

Learn more