News

"MicroStrategy und Bitcoin Magazine präsentieren 'Bitcoin für Unternehmen' auf der Bitcoin-Konferenz"

Initiative "Bitcoin for Corporations" MicroStrategy und Bitcoin Magazine haben die Initiative "Bitcoin for Corporations" ins Leben gerufen, um Unternehmen die Bitcoin-Adoption (Einführung und Nutzung von Bitcoin) zu erleichtern. Michael Saylor von MicroStrategy kündigte diese Zusammenarbeit auf der Bitcoin Conference 2024 an. Das Projekt dient als Ressource und Netzwerk-Hub (Knotenpunkt für Verbindungen und Informationsaustausch) für Firmen, die den Einsatz von Bitcoin erforschen möchten. Gemeinsam gestaltete Webplattform Diese Initiative erweitert die bisherigen Bemühungen von MicroStrategy durch eine gemeinsam gebrandete Webplattform. Diese Plattform bietet kuratierte Inhalte (ausgewählte und aufbereitete Materialien), Newsletter, Erfolgsgeschichten, praktische Werkzeuge und Bildungsressourcen, die speziell für Führungskräfte auf C-Level (Vorstandsebene) zugeschnitten sind. Ziel ist es, Unternehmen bei der Entwicklung und Implementierung von Bitcoin-Strategien zu unterstützen. Dazu gehören auch strukturierte Outreach-Programme (gezielte Ansprache und Vernetzung) und VIP-Zugänge zu jährlichen Konferenzen. Mitgliedsstufen und Vorteile Die verschiedenen Mitgliedsstufen – Executive Partner, Premier Member und Industry Member – bieten unterschiedliche Vorteile. Dazu zählen strategische Inhalte, Masterclasses (intensive Lehrveranstaltungen), und VIP-Events, die eine breite Reichweite und Wirkung sicherstellen sollen. Für weitere Informationen besuche die Website b.tc/corporations.

Learn moreStart von Bitcoin Magazin Japan

Bitcoin Magazine und Metaplanet eröffnen neues Büro in Tokio, Japan Bitcoin Magazine und Metaplanet haben am 26. Juli 2024 die Eröffnung eines neuen Büros in Tokio, Japan, bekanntgegeben, um ihre internationale Präsenz auszubauen. Das Ziel dieses Schrittes ist es, lokalisierte, qualitativ hochwertige Inhalte rund um Bitcoin für den japanischen Markt bereitzustellen. Das unterstützende Bitcoin-Ökosystem in Japan, besonders in Tokio, macht die Stadt aufgrund ihres fortschrittlichen Finanzsektors und der technikaffinen Bevölkerung zu einem idealen Zentrum für diese Expansion. Partnerschaft zur Förderung der globalen Hyperbitcoinization Metaplanet, ein Unternehmen, das sich auf die Integration von Bitcoin in Unternehmensstrukturen spezialisiert hat, wird mit Bitcoin Magazine zusammenarbeiten, um die globale Hyperbitcoinization zu fördern. Unter Hyperbitcoinization versteht man den Übergang zu einem Wirtschafts- und Finanzsystem, das stark auf Bitcoin basiert. Diese Partnerschaft wird lokales Know-how nutzen, um Inhalte zu produzieren, die beim japanischen Publikum gut ankommen, darunter exklusive Interviews, Sonderveröffentlichungen und interaktive Sitzungen. Weitere internationale Expansion geplant Diese Initiative folgt auf den erfolgreichen Start von Bitcoin Magazine Schweiz und ist Teil einer umfassenderen Strategie zur Etablierung einer globalen Präsenz. Die Zusammenarbeit mit Metaplanet wird die Bitcoin-Adoption in Japan durch innovative und ansprechende Inhalte erleichtern und sieht die Erweiterung der Printpublikationen und Live-Events vor. Zukunftsaussichten und Strategie Bitcoin Magazine strebt an, zusätzliche Sprachen und Regionen zu unterstützen und ermutigt Partnerschaften für eine weitere internationale Expansion. Metaplanet, ein an der Tokioter Börse gelistetes Unternehmen, hat Bitcoin als Hauptreservevermögenswert angenommen. Ein Reservevermögenswert ist ein Vermögenswert, der als Rücklage gehalten wird, um finanzielle Stabilität zu gewährleisten. Metaplanet zielt darauf ab, diese Strategie zu nutzen, um den Aktionärswert zu steigern und die weltweite Bitcoin-Adoption voranzutreiben.

Learn moreMARA erwirbt Bitcoin im Wert von $100 Millionen und übernimmt die HODL-Strategie

MARA investiert 100 Millionen Dollar in Bitcoin MARA (NASDAQ: MARA), ein führender Akteur im Bereich der digitalen Vermögenswerte, hat 100 Millionen Dollar in Bitcoin investiert und seine Gesamtbestände auf über 20.000 BTC erhöht. Das Unternehmen hat eine neue Treasury-Policy (Finanzstrategie) eingeführt, die eine vollständige HODL-Strategie (Hold On for Dear Life, bedeutet das langfristige Halten von Kryptowährungen) verfolgt. Bei dieser Strategie werden alle geminten Bitcoins behalten und selektiv zugekauft. Glaube an den langfristigen Wert von Bitcoin Fred Thiel, Chairman und CEO von MARA, betonte den Glauben an den langfristigen Wert von Bitcoin und dessen Potenzial als bestes Reservevermögen. Er ermutigte Regierungen und Unternehmen, Bitcoin ebenfalls zu halten. Rückkehr zur Bitcoin-Halte-Strategie Salman Khan, der CFO von MARA, erklärte, dass aufgrund der aktuellen günstigen Bedingungen, wie der zunehmenden institutionellen Unterstützung und eines positiven makroökonomischen Umfelds (gesamtwirtschaftliches Umfeld), das Unternehmen zu seiner früheren Strategie zurückkehrt, Bitcoin zu behalten. Er wies darauf hin, dass der jüngste Preisrückgang von Bitcoin sowie die starke Bilanz (Finanzlage) von MARA eine Gelegenheit boten, die Bestände zu erhöhen. Nutzung von Bitcoin-Mining-Wärme in Finnland Zusätzlich verwendet MARA die beim Bitcoin-Mining entstehende Wärme, um eine Stadt mit 11.000 Einwohnern in Finnland zu beheizen.

Learn moreEgo Death Capital sammelt über $43 Millionen ein, um Bitcoin-Unternehmen zu finanzieren.

Ego Death Capital verkündet erfolgreichen Abschluss der ersten Finanzierungsrunde für zweiten Fonds Ego Death Capital, ein Venture-Capital-Fonds mit Spezialisierung auf Bitcoin-Technologie-Startups, hat den erfolgreichen Abschluss der ersten Finanzierungsrunde seines zweiten Fonds bekannt gegeben, der auf 100 Millionen Dollar angelegt ist. Dabei wurden 43,35 Millionen Dollar zugesagt. Investitionsziel des Fonds und bisherige Unternehmensbeteiligungen Dieser Fonds zielt darauf ab, Series-A-Investitionen – das sind frühe Investitionen in die Wachstumsphase eines Unternehmens – in schnell wachsende Bitcoin-Unternehmen zu unterstützen. Bisher hat Ego Death Capital in bekannte Startups wie Relai, Breez, Fedi und LN Markets investiert. Erweiterung des Führungsteams und Fokus der Investitionen Zu den Gründern Jeff Booth, Andi Pitt und Nico Lechuga sind kürzlich Preston Pysh und Lyn Alden als General Partner – das sind Geschäftsführende Gesellschafter – hinzugekommen. Nico Lechuga hob hervor, dass der Fonds mit seinem einzigartigen Fokus auf Series-A-Investitionen eine wichtige Unterstützungslücke für schnell wachsende Bitcoin-Startups schließt. Bedeutung für die Bitcoin-Technologie und weltweite Entwicklung Jeff Booth betonte die Bedeutung ihrer Arbeit und brachte zum Ausdruck, dass die Förderung von Fortschritten in der Bitcoin-Technologie Millionen von Menschen weltweit zugutekommen kann. Der erfolgreiche Abschluss der Finanzierungsrunde unterstreicht das zunehmende Interesse der Investoren am wachsenden Bitcoin-Technologiesektor und deutet auf die Reife des Ökosystems sowie das Potenzial für beschleunigte Entwicklungen hin.

Learn moreAlby: Ein Drehkreuz für die Bitcoin- und Lightning-Ökonomie

Entstehung von Alby Alby wurde im Dezember 2020 als Open-Source-Projekt von Michael Bumann, Moritz Kaminski und René Aaron ins Leben gerufen und im März 2022 zu einem Unternehmen umgewandelt. Mit einem vollständig remote arbeitenden Team von 10 Mitarbeiter:innen hat sich Alby vor allem durch seine Browser-Erweiterung einen Namen gemacht. Diese ermöglicht es Nutzer:innen, über das Lightning Network, ein Zahlungsprotokoll für Bitcoin-Transaktionen, Kryptowährungen zu senden und zu empfangen. Michael Bumann, ein erfahrener deutscher Webentwickler, hat das Ziel, Bitcoin-Transaktionen so flüssig wie den Datentransfer im Internet zu gestalten und Lightning-Zahlungen nahtlos in Webanwendungen zu integrieren. Alby-Wallet und Funktionen Die Alby-Wallet vereinfacht die Einrichtung und Nutzung von Lightning-Zahlungen und stellt eine LNURL-Adresse (eine standardisierte, benutzerfreundliche URL für Lightning-Zahlungen), eine Wallet-API (Programmierschnittstelle) und einen LNDHub (eine Software, die mehreren Nutzern die gemeinsame Nutzung eines Lightning-Nodes ermöglicht) zur Verfügung. Nutzer:innen können zwischen Custodial (Verwahrung durch Dritte) und Non-Custodial (selbstverwaltete) Optionen wählen, indem sie entweder ihren eigenen Node betreiben oder die Dienste von Alby nutzen. Neue Features und Entwicklung Aufgrund der hohen Nachfrage ist die Einrichtung von Accounts bei Alby derzeit nur auf Einladung möglich. Das Team arbeitet an Nostr Wallet Connect (NWC), einem Protokoll zur Integration von Nostr-Relays (Netzwerkknoten für dezentralisierte Nachrichten), um Lightning-Invoices zu senden und die Verbreitung des Lightning-Netzwerks zu fördern. Die neue Wallet von Alby, die den Fokus auf NWC legt, soll das Benutzererlebnis durch die Vereinfachung der Ersteinrichtung und die Automatisierung von Zahlungen verbessern. Zukünftige Pläne Zukünftige Pläne für Alby umfassen die Feinabstimmung von NWC, die mögliche Integration mobiler Anwendungen, die Berücksichtigung von Implementierungen wie Bolt 12 (ein Vorschlag zur Verbesserung der Flexibilität von Lightning-Zahlungsanfragen) und die Erforschung von ecash-Systemen (elektronisches Bargeld) wie Cashu und Fedi. Der engagierte Kundenservice des Teams sammelt Nutzerfeedback, um das Produkt kontinuierlich zu verbessern und Herausforderungen der frühen Anwender zu bewältigen. Michael Bumann und Teamarbeit Michael Bumann betont die Bedeutung der Verbindung zu den Nutzererfahrungen und dem Feedback. Innerhalb des Teams pflegt er einen kollaborativen Ansatz, um die Dienste von Alby stetig zu verbessern. Trotz des schnellen Wachstums legt er Wert auf Bescheidenheit und den direkten Kontakt mit den Nutzer:innen, um die Benutzerfreundlichkeit ihrer Lösungen zu steigern.

Learn moreAlby eröffnet Warteliste für Alby Hub: Ein One-Click Lightning Node

Alby Hub - Die Vereinfachung der Nutzung von Lightning Nodes Alby hat eine Warteliste für den Alby Hub gestartet – eine benutzerfreundliche Lightning Node-Anwendung, die die Nutzung selbstverwahrter (self-custodial) Lightning Nodes wesentlich vereinfacht. Diese Anwendung umfasst eine One-Click Lightning Node, mit der Nutzer eine Lightning Node mit einem Klick einrichten können, und eine selbstverwahrte Lightning Wallet. Ein integrierter App-Store ermöglicht die einfache Integration von Anwendungen wie Damus (einer Social-Media-Plattform) und Stacker News (einer Nachrichtenplattform für Bitcoin-Enthusiasten). Wechseln zur Alby Hub Plattform Nutzer können mühelos von Albys Web-Wallet zu Alby Hub wechseln. Zusätzlich bietet das Produkt den Alby Hub Cloud Plan für 21.000 Satoshis monatlich an. Dieser Plan umfasst das Live-Channel-Management, Unterstützung bei der Einrichtung und Zugang zur Community. Alby Hub lässt sich auch auf persönlichen Geräten wie einem Raspberry Pi Zero installieren. Das Ziel von Alby Das Hauptziel von Alby ist es, die Abhängigkeit von fremdverwahrten (custodial) Lightning-Lösungen zu verringern und Selbstverwahrung zugänglicher zu machen, sodass Nutzer die volle Kontrolle über ihre Lightning-Gelder besitzen. Der Gründer von Alby unterstreicht, dass Alby Hub die Selbstverwahrung im Lightning Network verbessert und die Integration mit Bitcoin-gestützten Apps erleichtert.

Learn moreFerrari akzeptiert Bitcoin und Krypto-Zahlungen in Europa

Ferrari ermöglicht Krypto-Zahlungen in Europa Ferrari ermöglicht ab diesem Monat Krypto-Zahlungen bei seinen europäischen Händlern, nachdem dies letztes Jahr erfolgreich in den USA eingeführt wurde. Der weltweite Rollout, also die schrittweise Einführung, soll bis Ende 2024 abgeschlossen sein, vorbehaltlich lokaler Vorschriften. Zusammenarbeit mit BitPay Ferrari arbeitet mit BitPay zusammen, um Bitcoin-Zahlungen sofort in Fiat-Währung, also traditionelle Währung wie Euro oder Dollar, umzuwandeln und so die Volatilitätsrisiken für seine Händler zu minimieren. Technikaffine Kunden im Blick Dieser Schritt zielt auf Ferraris technikaffine Kunden ab und steht im Einklang mit dem breiteren Trend einer zunehmenden Bitcoin-Adoption durch große Unternehmen wie Microsoft und Expedia. Steigende Nachfrage auf dem US-Markt Ferrari betonte, dass dieser Schritt die Bequemlichkeit und Flexibilität für Käufer von Luxusfahrzeugen erhöht hat und zu einer starken Nachfrage auf dem US-Markt beigetragen hat. Da immer mehr Luxusmarken Krypto akzeptieren, wird Bitcoin zunehmend als Währung für hochpreisige Transaktionen legitimiert.

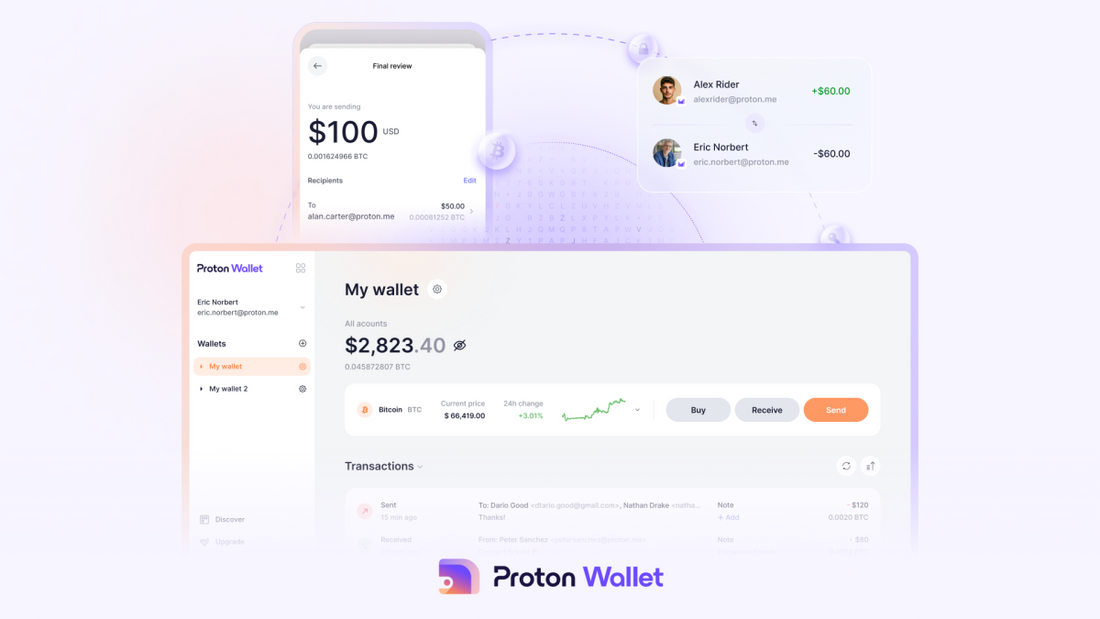

Learn moreProtonMail-Macher Proton startet seine eigene Bitcoin-Wallet.

Proton präsentiert Proton Wallet Das Schweizer Technologieunternehmen Proton hat ein neues Produkt auf den Markt gebracht: Proton Wallet. Dieses selbstverwaltete Bitcoin-Wallet, das in ProtonMail integriert ist, ermöglicht einfache Bitcoin-Transaktionen per E-Mail. CEO Andy Yen betont, dass das Tool die Nutzung von Bitcoin vereinfacht, ohne die dezentrale Natur der Kryptowährung zu beeinträchtigen. Proton Wallet ergänzt eine Reihe von datenschutzfokussierten Werkzeugen, die Proton bereits anbietet. Das Produkt wurde entwickelt, weil Bitcoin in der Geschichte von Proton eine wichtige Rolle gespielt hat. Bitcoin half dem Unternehmen beispielsweise, als PayPal während eines Crowdfundings von Proton Gelder eingefroren hatte, und beim Erhalt der Reserven während des Zusammenbruchs der Credit Suisse im März 2023. Abhängigkeit von zentralisierten Finanzinstituten verringern Direktor Dingchao Lu erklärte, dass das Unternehmen die Abhängigkeit von zentralisierten Finanzinstituten verringern will. Dies soll erreicht werden, indem Nutzern die Kontrolle über ihre Verschlüsselungsschlüssel und digitalen Assets gegeben wird. Seit 2016 akzeptiert Proton Bitcoin-Zahlungen und hat von der Wertsteigerung dieser Kryptowährung profitiert. Merkmale von Proton Wallet Proton Wallet nutzt die bestehende Proton-Infrastruktur, um die Benutzerfreundlichkeit zu gewährleisten. Zum Versenden von Bitcoin benötigt man lediglich die E-Mail-Adresse des Empfängers. Das System rotiert Bitcoin-Adressen, um die Privatsphäre zu wahren. Als non-custodial Wallet, also ohne Verwahrung durch Dritte, haben nur die Nutzer selbst Zugriff auf ihre Gelder. Es wurden robuste Wiederherstellungsmethoden implementiert. Transaktionen finden auf der Base-Chain, der Haupt-Blockchain von Bitcoin, statt. Die Unterstützung des Lightning Network, eines Zusatzprotokolls für schnellere Transaktionen, ist zunächst nicht vorgesehen, da Herausforderungen im Benutzererlebnis bestehen. Eine zukünftige Unterstützung des Lightning Network wird jedoch in Betracht gezogen. Zukünftige Pläne und Verfügbarkeit Proton plant, in über 150 Ländern On-Ramps zu integrieren. On-Ramps erleichtern den Kauf von Bitcoin durch direkte Umwandlung von Fiatgeld in Kryptowährungen. Zudem bietet Proton Zwei-Faktor-Authentifizierung und nutzt Proton Sentinel, ein Sicherheitsfeature, für zusätzlichen Schutz. Derzeit ist Proton Wallet für Proton Visionary-Nutzer und ausgewählte Mitglieder der Bitcoin-Community verfügbar. Eine breitere Verfügbarkeit ist geplant, und es wurde eine Warteliste für interessierte Nutzer eingerichtet.

Learn moreBitcoin Mining und HPC-Branchenführer schließen sich zusammen, um Synteq Digital zu gründen

Synteq Digital: Fusion von SunnySide Digital und Cryptech Solutions SunnySide Digital und Cryptech Solutions haben sich zusammengeschlossen, um Synteq Digital zu gründen. Ziel dieser Fusion ist es, den Bedürfnissen der Digital-Mining- und High-Performance-Computing- (HPC, Hochleistungsrechnen) Branchen gerecht zu werden. Das Unternehmen plant, sein Geschäft im Bereich Hardware-Großhandel auszubauen und neue Dienstleistungen einzuführen. Services und Expansionspläne von Synteq Taras Kulyk, CEO von Synteq und ehemaliger CEO von SunnySide, betont das Potenzial von Synteq, umfassende Services für Unternehmenskunden in den Bereichen HPC und Digital Mining anzubieten. Synteq plant, diverse neue Services anzubieten, darunter die Beschaffung, Colocation (Unterbringung von Servern in einem Rechenzentrum eines Drittanbieters) und den Großhandel von unternehmensfokussierter GPU/HPC-Hardware. Weitere geplante Dienstleistungen sind ein Just-In-Time (bedarfsgerecht zeitnahes) DataCenter-Ersatzteilservice und ein Fleet Refresh Service Modell (Austausch von Unternehmensflotten-Hardware). Das Unternehmen strebt an, bestehende Partnerschaften zu verbessern und in neue Märkte weltweit zu expandieren. Partnerschaften und exklusiver Vertrieb Eine der bedeutendsten frühen Partnerschaften von Synteq ist die mit Bitmain Technologies, einem führenden Hersteller von Bitcoin-Mining-Rigs. Synteq wird Bitmains exklusiver Vertriebspartner in den Vereinigten Staaten. Diese Partnerschaft entstand als Reaktion auf die Konsolidierung der Branche und erlaubt es Synteq, den steigenden Anforderungen großer Digital-Mining- und HPC-Kunden gerecht zu werden. Prognose für die Zukunft von Synteq Joe Stefanelli, Präsident von Synteq und ehemaliger CEO von Cryptech, prognostiziert, dass Synteq dank seiner Expertise, Integrität und zuverlässigen Services schnell zu einem globalen Marktführer in diesem Bereich werden wird. Sowohl Kulyk als auch Stefanelli betonen die strategische Ausrichtung und die geteilten Werte zwischen SunnySide und Cryptech und sehen erhebliche Vorteile in ihrer gemeinsamen Anstrengung.

Learn more