News

Bitcoin donor pays $500,000 for Julian Assange’s freedom flight

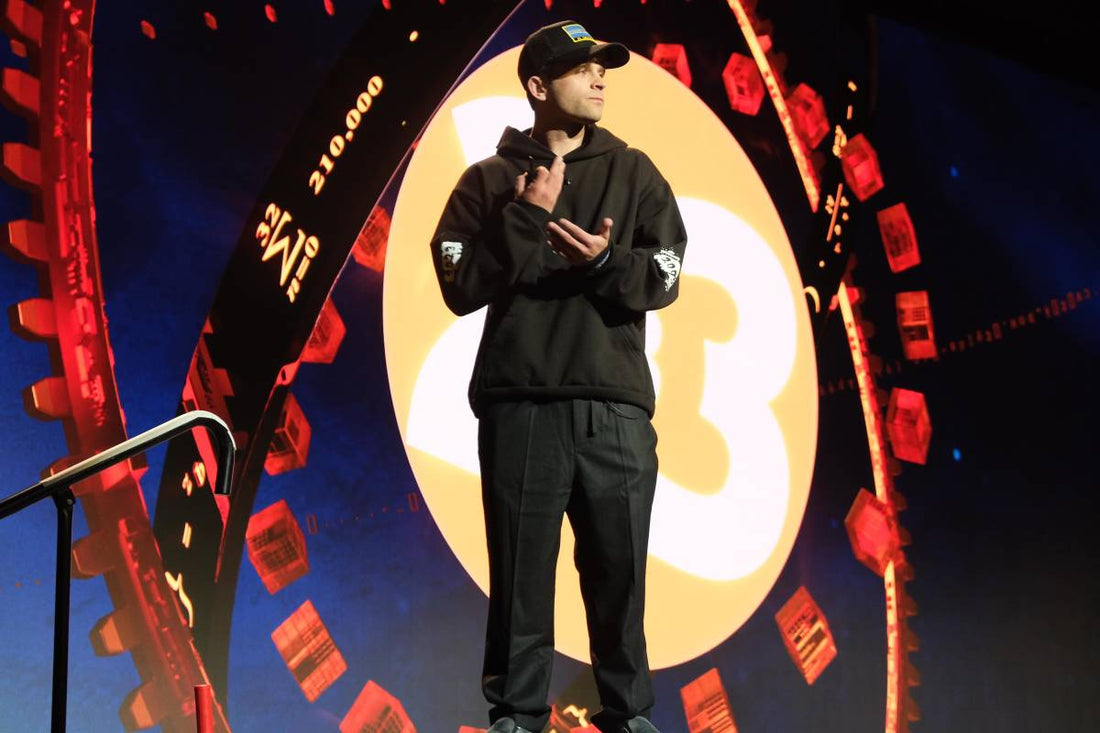

Anonymous Bitcoin donor supports Julian Assange An anonymous Bitcoin donor paid over $500,000 in BTC (bitcoin, a digital currency) to cover the cost of Julian Assange's flight back to Australia. Assange, who fought extradition for 14 years on espionage charges related to WikiLeaks, returned a free man. On June 24, he was released from a British prison after pleading guilty in a US court under a plea agreement. Support from the Bitcoin community On June 25, his wife posted an urgent appeal for donations to cover the $520,000 cost of a private charter flight. A single Bitcoin donor sent over 8 BTC, equivalent to nearly $500,000, to cover the costs. This generous contribution demonstrates the Bitcoin community's long-standing support for Assange, as well as the role of technology in promoting freedom of expression and financial independence. Julian Assange's connection to Bitcoin Assange has long been a Bitcoin proponent and pioneer, and has been associated with the cryptocurrency since WikiLeaks began receiving BTC donations in 2010. His return to Australia marks a significant victory for his supporters and sheds light on the ongoing conflict between individual freedoms and state power. Assange is expected to recover after his lengthy incarceration and may continue to be active in the Bitcoin space.

Learn moreCongressman Matt Gaetz introduces bill to pay federal taxes in Bitcoin.

Bitcoin as a payment method for federal income taxes Congressman Matt Gaetz has introduced legislation that would allow federal income taxes to be paid in Bitcoin. The bill aims to amend the Internal Revenue Code of 1986 by directing the Secretary of the Treasury to create guidelines for Bitcoin tax payments (Bitcoin is a digital cryptocurrency). Gaetz argues that this move would modernize the tax system, encourage innovation, and increase efficiency. The proposal includes the immediate conversion of Bitcoin to U.S. dollars upon receipt and addresses related non-tax matters such as contracts, fees, and liability issues. Political acceptance and regulatory efforts This initiative follows growing political support for Bitcoin in the US. Well-known figures such as Donald Trump and Robert F. Kennedy Jr. are accepting Bitcoin payments for their presidential campaigns. The Biden campaign is also considering accepting cryptocurrency donations, and government officials plan to attend a Bitcoin roundtable in Washington DC. Brian Armstrong, the CEO of Coinbase (a cryptocurrency trading platform), recently met with senators to discuss clear regulations for the crypto industry. Additionally, Congressman Thomas Massie announced a bill to abolish the Federal Reserve (the central bank of the US) after reading "The Bitcoin Standard."

Learn moreLatin America's largest fintech bank integrates Bitcoin Lightning payments.

Nubank and Lightspark partnership Nu Holdings, known as Nubank and the largest fintech bank in Latin America, has partnered with Lightspark to integrate the Bitcoin Lightning Network and Universal Money Addresses (UMA) into its platform. This integration aims to enable near real-time and low-cost Bitcoin and fiat transactions, improving Nubank's services to its large customer base. David Marcus' enthusiasm Lightspark CEO David Marcus was excited about the collaboration and highlighted the potential benefits for Nubank's 100 million customers, particularly in making financial transactions easier and more efficient. The partnership leverages Lightspark's advanced technology, including software development kits (SDKs), application programming interfaces (APIs) and AI tools, to ensure seamless integration and optimization. Thomaz Fortes' statement Thomaz Fortes, Executive Director at Nubank Cripto, explained that the collaboration with Lightspark is in line with Nubank's mission to offer the best solutions for its customers and strengthen long-term customer relationships. The planned integration of the Lightning Network is expected to enable more efficient services with higher speed and lower costs through blockchain technology. This collaboration represents a significant milestone for the Lightning Network and could increase its overall usage as well as improve Nubank's Bitcoin services for its customers in Brazil, Mexico and Colombia.

Learn moreGerman government transfers millions of euros into Bitcoin.

Bitcoin transfer to crypto exchanges The German government has transferred millions of seized Bitcoin to major crypto exchanges Kraken and Coinbase. These transfers, which originated from a wallet linked to Germany's Federal Criminal Police Office (BKA), include $24 million sent to the exchanges, as well as an additional $30 million to an unidentified wallet. This follows a previous movement of $195 million in Bitcoin on June 19 and 20. This brings the total Bitcoin transfers to over $425 million in the past week. Possible sale of Bitcoin assets Although the government is keeping the majority of the seized bitcoin, these transactions indicate a possible plan to liquidate some of these assets. Selling such bitcoin could put downward pressure on the price, which has already fallen below $60,000 on the news. The wallet still holds over 46,000 bitcoin, worth nearly $3 billion, which has increased significantly in value since its seizure in 2013.

Learn moreBitcoin Lightning App Strike is expanding in the UK.

Bitcoin Lightning Payments App Strike Expands in the UK Strike, a Bitcoin Lightning Payments app, has expanded to the United Kingdom, allowing residents to buy, sell and transfer Bitcoin globally. Founded by Jack Mallers, Strike uses the Lightning Network - a network for faster and cheaper Bitcoin transactions - and makes Bitcoin accessible through its mobile app. Now available in 100 countries, Strike remains committed to driving Bitcoin adoption, despite the regulatory challenges that exist. Bitcoin Appropriateness Assessment and App Features In the UK, users must complete a Bitcoin Appropriateness Assessment quiz, in accordance with local regulations. The app offers features such as instant transfers for Bitcoin purchases, recurring purchases, and self-custody withdrawals. It also enables instant, free global payments between Strike users via the Lightning Network. Strike sees potential in the UK Although some companies have exited the UK market, Strike sees potential in the UK, the world's sixth-largest economy. The company aims to make Bitcoin accessible to both everyday users and businesses, navigating regional regulations while maintaining core functionality.

Learn moreBitcoin layer landscape continues to evolve.

At the Bitcoin++ Developer Conference In Austin, Texas, Michael von Boltz and Tiero from Ark Labs discussed current advances in Bitcoin technology, highlighting the Lightning Network, Liquid, and emerging technologies like Ark. Lightning Network and Submarine Swaps Michael highlighted the challenges of the Lightning Network, especially in environments with high transaction fees, and proposed settling transactions via Submarine Swaps, a method of linking on-chain and off-chain transactions, as a solution. Role of the Lightning Network and Liquid Tiero pointed out the need for innovative designs to integrate the different Bitcoin layers and highlighted the central role of the Lightning Network (a payment channel network that enables fast and low-cost Bitcoin transactions). Regarding Liquid, Michael praised its stability and resilience. Tiero added that Liquid helps reduce congestion on the main Bitcoin blockchain, resulting in lower transaction fees and faster processing times. Michael highlighted Liquid's proven reliability despite new blockchain proposals and emphasized its long-term relevance. Role of Boltz and market efficiency Michael explained the role of Boltz, a liquidity service that facilitates fluid exchanges between different Bitcoin layers to ensure a connected ecosystem. He advocated competition among service providers to ensure market efficiency and advocated for trials and experiments before standardizing protocols. Ark Protocol and Innovation Tiero introduced Ark as a protocol that integrates with existing technologies such as the Lightning Network. He emphasized the importance of practical applications and user needs and advocated for experimentation in flexible environments such as Liquid to further improve the Ark protocol. Future prospects and Covenant technology Both expressed confidence in the future of Bitcoin's various layers and the so-called covenant technology (a method of attaching conditions to Bitcoin transactions). Tiero praised the advances in covenant technology, while Michael highlighted Rusty Russell's project to improve Bitcoin's scripting capabilities as a significant development.

Learn moreBitcoin Lightning Alliance accelerates adoption with new asset protocol.

LN Alliance: Promoting the Lightning Network LNFi leads a coalition called the LN Alliance to promote the adoption of the Lightning Network (LN) by leveraging protocols such as Taproot Assets and Nostr. The initiative aims to unify standards across the Bitcoin ecosystem to improve interoperability and avoid duplicate development efforts. LN Link and Taproot Assets A key part of this initiative is LN Link, which enables Bitcoin apps to interact with Taproot assets, improving asset management in the Bitcoin ecosystem via the Lightning Network. Taproot assets are versatile digital assets that support advanced scripting and increased scalability without overloading the blockchain, making them an essential part of the network's infrastructure. Integration of Lightning and Taproot Assets Ryan Gentry of Lightning Labs emphasized the importance of integrating Lightning with Taproot Assets as it simplifies the processing of asset transactions by leveraging familiar application programming interfaces (APIs). Graham Krizek highlighted that the goal is to make the Lightning Network accessible and reliable, especially by incorporating stablecoins to expand the user base. LN Alliance’s vision for the future The coalition envisions a future where the Lightning Network facilitates cross-network transactions without centralized intermediaries. Efforts include creating development kits for wallets that allow easy connection to swap providers, improving efficiency and connectivity. Economic opportunities through Taproot Assets Jesse Shrader of Amboss focused on the economic opportunities, pointing out revenue opportunities through routing fees and channel leasing. The increased activity from Taproot assets is expected to increase network liquidity and create new business opportunities for Lightning node operators and entrepreneurs. LN Alliance: Promoting the Bitcoin financial market The LN Alliance aims to promote economic growth and develop a robust Bitcoin financial market by leveraging their collective efforts to expand the utility and reach of the Lightning Network.

Learn moreMt. Gox will begin paying out Bitcoin in July.

Bitcoin exchange Mt. Gox announces distribution of assets Bankrupt Bitcoin exchange Mt. Gox has announced that it will begin distributing assets to victims of its 2014 hack in July. Nobuaki Kobayashi, the trustee in charge of the rehabilitation, confirmed that repayments in Bitcoin and Bitcoin Cash will be made starting in early July 2024, stressing the need for careful security measures. Background of Mt. Gox and the stolen Bitcoins Mt. Gox, which once processed over 70% of Bitcoin transactions, filed for bankruptcy in 2014 after around 740,000 Bitcoins were stolen by hackers. Those stolen Bitcoins are now worth about $15 billion. Efforts to compensate victims have encountered numerous delays. A Tokyo court set a deadline of October 2024 for the civil reorganization plan. In May, the exchange moved 140,000 BTC for the first time in five years, likely in preparation for repayments. Hope for victims and distribution of assets Victims who have waited over a decade to get their funds back now have new hope. The repayments will include 142,000 Bitcoins, 143,000 Bitcoin Cash and 69 billion Japanese yen. These assets will be distributed to approximately 127,000 creditors, with partnerships with exchanges playing a role based on the progress of due diligence. Concerns and impacts on the Bitcoin market There are concerns about the potential impact of large payouts on the Bitcoin market price if recipients sell their refunded funds. Nevertheless, the refunds mark a significant step toward resolving a pivotal incident in Bitcoin's history.

Learn moreStandard Chartered sets up Bitcoin trading desk.

Standard Chartered launches spot trading desk for Bitcoin and Ether Global banking giant Standard Chartered will launch a spot trading desk for Bitcoin and Ether, making it one of the first major banks to offer direct spot Bitcoin trading services. The new trading desk, which is part of the bank's FX (Foreign Exchange Trading) unit in London, will cater to rising demand for cryptocurrencies from institutional investors. Standard Chartered has been positive on Bitcoin for several years. Cooperation with regulators for Bitcoin and Ether trading The bank is working with regulators to facilitate Bitcoin and Ether trading for its institutional clients. Standard Chartered already offers crypto custody services through its stake in Zodia Custody and is an investor in Zodia Markets, a company specializing in institutional Bitcoin and crypto trading. Bitcoin ETFs and institutional interest in Bitcoin This new trading desk is the next step in Standard Chartered's commitment to Bitcoin. The initiative comes at the same time as the approval and launch of Bitcoin ETFs (exchange-traded funds) in major markets such as the US, UK, Hong Kong and Australia. These developments highlight the growing institutional interest in Bitcoin. Institutional acceptance and accelerated mainstream adoption of Bitcoin Standard Chartered's direct Bitcoin trading services underscore the accelerated mainstream adoption of Bitcoin and reflect banks' recognition of Bitcoin as a new essential asset class. This development is likely to encourage wider institutional adoption and encourage other major banks to also offer spot Bitcoin trading.

Learn more