How does Bitcoin mining work?

1. Collect transactions: First, the network collects unconfirmed transactions in a so-called "mempool". When a user sends a transaction, the transaction ends up in this mempool. It is comparable to a queue.

2. Formation of blocks: Miners select transactions from the mempool and group them into a block. For economic reasons, they always select the transactions that generate the most fees.

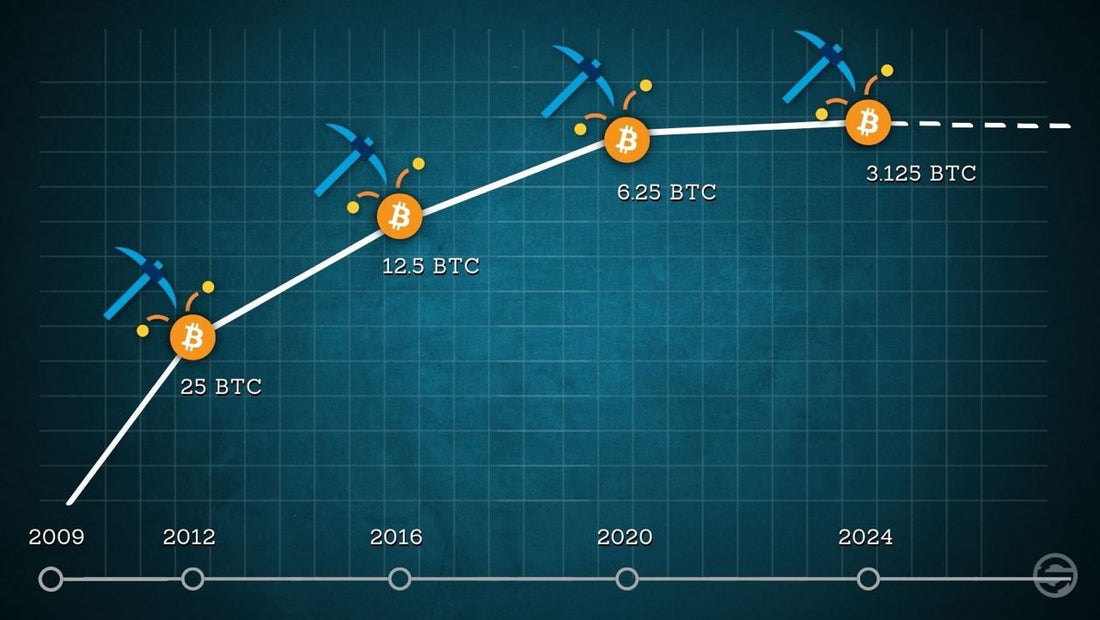

3. Reward for miners: Miners are rewarded for their energy expenditure with new Bitcoin. This is the mechanism that brings new Bitcoin into circulation. From 2009 to 2012 it was 50 Bitcoin per block, 2012-2016 25 Bitcoin, 2016-2020 12.5 Bitcoin, 2020-2024 6.25 Bitcoin and since the halving in April 2024 only 3.125 Bitcoin. This represents Bitcoin's monetary inflation, which was around 1.6% before the halving in 2024 and has halved to 0.8% since the halving, meaning that inflation is now lower than it is for gold.

Challenges and future prospects

Bitcoin miners are faced with the dilemma that halving reduces their turnover by 50% every four years. This indirectly forces miners to constantly reduce their costs as much as possible in order to achieve maximum efficiency.

The biggest items are electricity consumption and hardware costs. Halving every four years means that miners are always on the lookout for cheaper electricity, which can primarily be found in unpopulated areas of the world through surplus energy, i.e. electricity that would otherwise not be purchased by anyone.

Conclusion

Bitcoin mining is a fascinating process that ensures the integrity of Bitcoin.

Discover your Nerdminer